ETH Price Prediction: Navigating Volatility with Key Technical and Fundamental Insights

#ETH

- ETH is testing crucial technical support levels with Bollinger Bands indicating potential rebound zones

- Mixed fundamental signals with institutional adoption progress counterbalanced by whale movement concerns

- MACD momentum suggests underlying strength despite short-term price pressure

ETH Price Prediction

ETH Technical Analysis: Key Levels to Watch

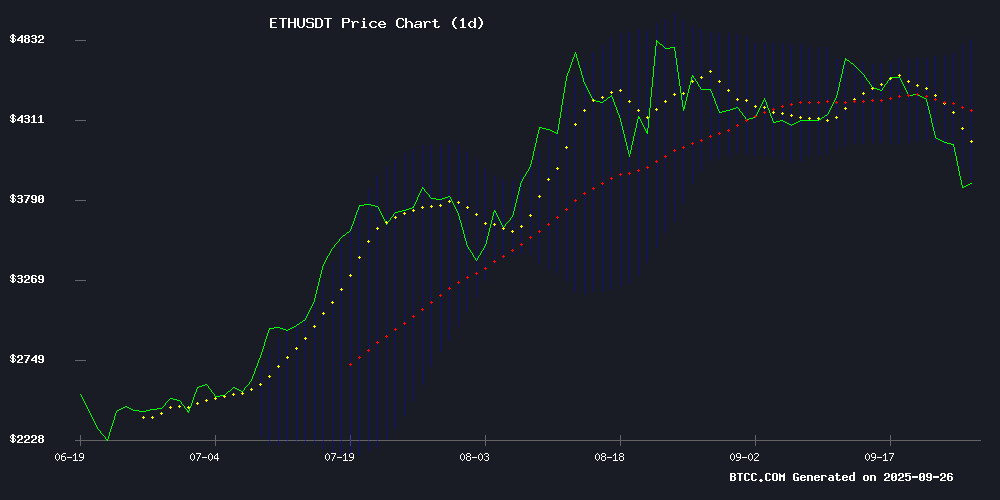

ETH is currently trading at $4,032.55, below its 20-day moving average of $4,386.71, indicating short-term bearish pressure. The MACD shows a positive histogram of 95.16, suggesting potential upward momentum despite recent declines. Bollinger Bands position the price NEAR the lower band at $3,958.44, which could act as support. According to BTCC financial analyst Olivia, 'The technical setup shows ETH is testing crucial support levels. A hold above $3,950 could pave the way for a retest of the $4,400 resistance zone.'

Market Sentiment: Mixed Signals Amid Institutional Developments

Recent news presents a complex picture for Ethereum. Positive developments include SWIFT's pilot with Consensys' ethereum Layer-2 Linea and increased institutional adoption, while concerns arise from co-founder deposits and supply hitting multi-year lows. BTCC financial analyst Olivia notes, 'The fundamental backdrop shows contrasting forces - institutional progress versus whale movement patterns creating uncertainty in the short term.'

Factors Influencing ETH's Price

Ethereum Faces Price Pressure as Co-Founder Deposits Millions Amid Whale Accumulation

Ethereum's market dynamics took a speculative turn as co-founder Jeffrey Wilcke moved $5.99 million worth of ETH to Kraken, sparking sell-off fears. The transaction coincided with ETH testing the $3,950 support level—a breach below $3,900 could trigger an 11% decline.

Contrasting this bearish signal, institutional whales seized the dip to accumulate 406,117 ETH ($1.6 billion) through Kraken. Major players like Galaxy Digital and FalconX led the buying spree, creating a tension between sell-side anxiety and institutional conviction.

The altcoin now faces a critical technical juncture. While whale activity suggests long-term confidence, Wilcke's exchange deposit introduces near-term uncertainty—a dichotomy that may define ETH's price trajectory in coming sessions.

Swift Pilots Blockchain Messaging System with Consensys' Ethereum Layer-2 Linea

Swift, the global payments network backbone for over 11,000 banks, is testing a blockchain-based upgrade to its Core messaging system. Partnering with Consensys' ethereum layer-2 solution Linea, the pilot involves major institutions like BNP Paribas and BNY Mellon. The multi-month experiment could redefine interbank communications through decentralized technology.

The move addresses longstanding criticisms of Swift's centralized infrastructure—high costs, slow settlements, and intermediary dependencies. Linea's appeal lies in its regulatory-compliant privacy features, leveraging advanced cryptography while maintaining Ethereum compatibility. This positions Swift at the intersection of traditional finance and blockchain's settlement efficiency.

Banking insiders describe the initiative as a potential watershed for cross-border payments. While still experimental, the collaboration signals growing institutional recognition of blockchain's capacity to modernize financial plumbing. The pilot's success could accelerate adoption of hybrid systems bridging legacy and decentralized networks.

SWIFT Partners with Major Banks to Test On-Chain Transactions Using Ethereum's Linea Network

SWIFT, the global financial messaging cooperative, is reportedly collaborating with over a dozen major banks to test on-chain payment transactions and messaging using Ethereum's Layer-2 network Linea. Institutions including BNP Paribas and BNY Mellon have selected Linea for its advanced ZK rollup technology, which offers low-cost, high-throughput transactions.

The project, expected to take months to complete, could mark a significant technological shift in international interbank payments. SWIFT hinted at developing new rules with a coalition of more than 30 entities, signaling broader institutional adoption of blockchain infrastructure.

Linea's privacy-focused design and scalability make it an ideal candidate for large-scale financial applications. This initiative underscores the growing convergence of traditional finance and decentralized technologies.

Coinbase CLO Defends Base Network Against SEC Exchange Classification

Coinbase's chief legal officer Paul Grewal has pushed back against regulatory scrutiny of the company's Ethereum Layer-2 network Base, asserting it should not be classified as a securities exchange. In a Bankless interview, Grewal emphasized Base operates as blockchain infrastructure rather than a trading venue matching securities buyers and sellers.

The debate centers on whether Layer-2 sequencers qualify as exchanges under SEC rules. Grewal maintains transaction matching occurs in applications built atop Base, not at the protocol level itself. The clarification comes as regulators increasingly examine the role of Layer-2 solutions in digital asset markets.

Ethereum Supply On Exchanges Hits Multi-Year Lows Amid Market Pullback

Ethereum reserves on major exchanges have plummeted to their lowest levels in years as ETH prices dipped below $4,000. Binance and Coinbase Advanced recorded significant outflows, with the 50-day SMA netflow sinking below -40,000 ETH per day—a level last seen in February 2023.

The sustained withdrawal trend suggests tightening spot market supply, historically a precursor to upward price pressure. Institutional platforms like Coinbase Advanced mirror this depletion, signaling broad-based accumulation across market participants.

Dormant Ethereum Whales Awaken, Moving $785 Million After Eight Years

Two long-inactive Ethereum wallets, untouched since the network's early days, suddenly transferred 200,000 ETH ($785 million) to new addresses. The movement occurred just as ETH dipped below $4,000, sparking speculation about potential OTC deals or portfolio rebalancing.

Blockchain data reveals these wallets originally acquired ETH via Bitfinex during Ethereum's infancy. Despite the massive transfer, the anonymous holder retains 736,316 ETH ($2.9 billion) across eight addresses—suggesting no imminent market dump. Ethereum currently trades at $3,936, down 2% amid volatile swings between $3,829 and $4,020.

Ethereum Stuck Below $4,060: A Fakeout Or Fresh Leg Down To $3,600?

Ethereum hovers at a critical juncture after rebounding from the $3,800 liquidity level, only to stall beneath the $4,060 resistance zone. Traders are divided on whether this pause signals an impending recovery or the precursor to a deeper decline toward $3,600.

Analyst Ted notes ETH's successful test of $3,800 as anticipated, with buyers stepping in to catalyze a short-term bounce. Yet the failure to reclaim $4,060 as support leaves the market exposed. A decisive flip above this level could reignite bullish momentum, while rejection risks accelerating downside toward lower support thresholds.

Pepeto's $6.8M Presale Gains Traction Amid Ethereum Market Volatility

Pepeto, a meme coin built on Ethereum, has raised over $6.8 million in its presale as of September 25, 2025. The project merges meme culture with utility-driven infrastructure, attracting investors during Ethereum's recent pullback.

Ethereum faced significant selling pressure in late September, with $1.8 billion in crypto positions liquidated—including $210 million tied to ETH. Failed resistance at $4,500 triggered Leveraged liquidations, pushing ETH below $4,100. Daily trading volumes spiked 18% to $41.6 billion, reflecting heightened short-term activity.

Grayscale's Ethereum Trust recorded $196.6 million in outflows on September 24, signaling profit-taking after ETH's 63% three-month rally. Despite this, ETFs maintain substantial exposure, holding 6.3 million ETH worth approximately $25 billion.

Over 226,000 Crypto Traders Liquidated as Ethereum Leads $1.24B Market Carnage

The cryptocurrency market endured a brutal 24-hour liquidation storm on September 26, 2025, with Ethereum positions accounting for $312 million of the $1.24 billion wipeout. Phoenix Group data reveals 226,419 traders were forcibly exited from leveraged positions, with long bets suffering disproportionately across major exchanges.

Bybit recorded the highest liquidation volume at $257.71 million, where 90.36% were long positions. Hyperliquid followed with $219.72 million in liquidations—95.79% longs—while Binance saw $206.13 million evaporate from predominantly bullish bets. The bloodbath extended to OKX ($94.83M), Gate ($87.54M), and HTX ($69.73M), each reporting over 75% long-position casualties.

BitMEX's $22.18 million liquidation event stood out with 99.9% long-position devastation. The market rout underscores the perils of excessive leverage during volatility, particularly for Ethereum traders who bore the brunt of the sell-off.

Ethereum and Related Assets Drop 11.3% Amid Macroeconomic Pressures

Ethereum (ETH) fell 11.3% this week, dragging down correlated assets like the iShares Ethereum ETF (ETHA) and Wrapped Ethereum (WETH) in lockstep. The decline reflects two sequential blows: profit-taking after a weekend rally, followed by a hotter-than-expected August inflation report that rattled risk assets.

Macroeconomic headwinds now threaten to delay anticipated Federal Reserve rate cuts, creating a hostile environment for volatile crypto assets. Ethereum's sensitivity to interest rate expectations amplified the selloff, with traders pricing in prolonged restrictive monetary policy.

The synchronized movement of ETH derivatives underscores Ethereum's maturation as a benchmark asset. ETF products and tokenized wrappers now propagate its price signals across financial markets, magnifying both rallies and corrections.

ETH ‘Historic’ RSI Signal Sparks Debate on Ethereum’s Price Trajectory

A rare oversold signal on Ethereum’s Relative Strength Index (RSI) has ignited a heated debate among analysts. Crypto strategist Quinten François flagged the reading as one of the largest oversold signals in history, suggesting a potential bullish rebound. ETH’s daily RSI hovers around 34, teetering between oversold and neutral territory.

Contrasting views emerge as AvaTrade cautions against premature optimism, emphasizing the need for broader market confirmation. HighStrike Trading echoes this sentiment, advising investors to await clearer signals before positioning. The divergence underscores the tension between technical indicators and market momentum in crypto’s volatile landscape.

How High Will ETH Price Go?

Based on current technical and fundamental analysis, ETH faces immediate resistance at the 20-day MA of $4,386.71. The MACD's positive momentum suggests potential for upward movement toward the Bollinger Band upper limit of $4,814.99 if buying pressure increases. However, market sentiment remains cautious due to recent liquidations and macroeconomic pressures.

| Price Level | Significance | Probability |

|---|---|---|

| $3,600 | Major Support | 30% |

| $4,400 | 20-day MA Resistance | 50% |

| $4,815 | Upper Bollinger Target | 20% |

BTCC financial analyst Olivia suggests, 'The $4,800 level represents a realistic medium-term target if institutional adoption continues and technical support holds.'